For decades, health systems have treated bad debt more or less as an inevitable loss – a frustrating but unavoidable byproduct of delivering care in a fragmented financial system. Once patient balances were returned from primary and/or secondary collection agencies, most organizations wrote those accounts down to zero or had only one option left: sell those accounts to a debt buyer. Often debt buyers only pay fractions of a penny on the dollar, and the process removes control of the patient relationship from the provider.

Today, the landscape is shifting rapidly. With changing patient financial behavior, regulatory pressures, and mounting restrictions on how bad debt can be pursued or sold, hospitals and physician groups must rethink their approach to terminal bad debt. Good news – there’s now a smarter way to recover dollars once thought lost, and it begins with first recognizing that most patients’ financial struggles are not permanent, with many often improving.

Why Traditional approaches fall short

Patients’ financial circumstances are ever changing. A patient who couldn’t pay a $2,000 balance in 2022 may be fully capable of paying it in 2025 after a job change, marriage, asset sell, debt reduction, or overall improvement in household financial stability. Yet in most cases, those patients are never re-engaged once their accounts are written off.

At the same time, collection rates are declining across the industry. Price competition among agencies (including debt-buyers), stricter documentation standards, and heightened regulatory scrutiny have made it more difficult (and more costly) for providers to rely solely on primary and secondary placement cycles.

The result has been staggering: tens of billions of dollars are written off as “terminal” or “dead” bad debt every year. These are balances that, under traditional thinking, are considered permanently uncollectable.

The Growing Regulatory Squeeze

Adding to the challenge is the wave of state and federal regulations reshaping medical debt collection practices:

- Restrictions on Selling Bad Debt: Today, more than half of the U.S. population lives in a state that has implemented restrictions or prerequisites on selling or purchasing medical bad debt.

- Outright Bans: States like New York and Vermont have banned the sale and purchase of medical bad debt altogether.

- Extra Steps & Compliance Costs: Other states require providers to send written notice to patients prior to the sale, perform an additional financial assistance screening, or demonstrate extraordinary collection efforts before transferring the debt.

- Consumer Protections: Increasing caps or outright bans on interest, limits on lawsuits, and wage garnishment restrictions further diminish the effectiveness of legacy collection models.

Taken together, these measures have made selling bad debt not only less profitable but also more complicated and risk laden.

Introducing MONITOR

Rather than writing off terminal bad debt or selling it for pennies, providers now have an opportunity to recover significantly more revenue – all while retaining control of the patient relationship.

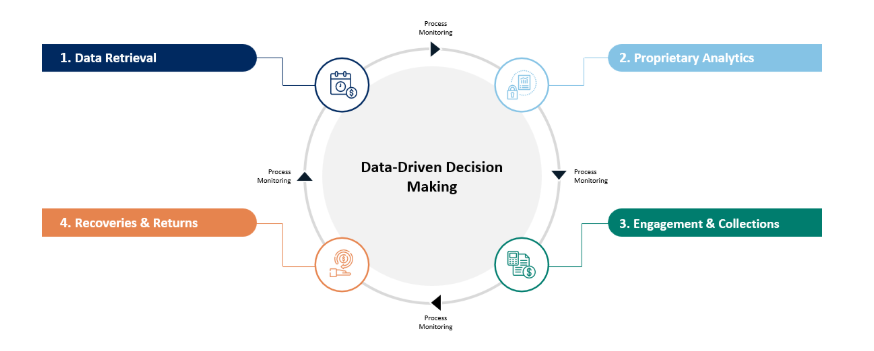

Introducing Monitor. Frost-Arnett’s MONITOR solution leverages advanced algorithms and machine learning to build a comprehensive patient profile using hundreds of financial indicators which monitor patients’ evolving propensity to pay over time. These insights help identify patients who may have regained the ability to pay, even months or years after their balance was written off.

MONITOR never relies on aggressive tactics. Instead, we re-engage patients with our proven, empathetic, satisfaction-driven strategies that preserve trust and strengthen the provider-patient relationship.

Two Options to Put MONITOR to Work

MONITOR offers flexibility to fit your organization’s strategy, with two proven pathways to cash recovery:

- ‘4-Year Lookback’

We can take your uncollectable, terminal bad debt from the past four years and re-engage those accounts through our segmentation and analytics engine. This process uncovers dollars you thought were gone forever, without disrupting your existing workflows. - ‘Forward Flow’

MONITOR can also serve as an ongoing campaign that plugs directly into your current processes. By adding an “additional wave” of engagement after primary and/or secondary placements, MONITOR extends your revenue horizon and ensures no opportunity slips through. Once accounts are returned as uncollectable from your primary and/or secondary collection agency, place the accounts with us in our “forward flow” campaign where we will monitor the accounts for 12-36 months, collecting as applicable.

Both approaches are fully Medicare Cost Reporting Compliant, and providers never lose a penny on their cost reports. Our propensity-to-pay algorithms seamlessly treat Medicare and non-Medicare accounts the same, ensuring every eligible patient is considered. We can even partner directly with your cost reporting teams if desired, streamlining compliance from day one.

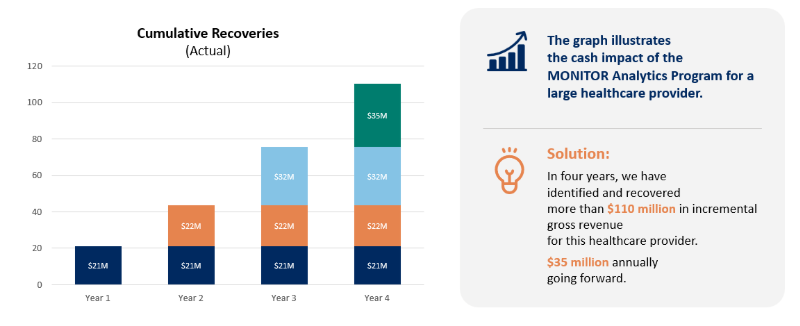

Proven Results, Minimal Lift

The outcomes speak for themselves. Organizations that have implemented MONITOR consistently report a 20%+ lift in bad debt recoveries, far surpassing the returns of traditional selling. MONITOR is also light to implement – all we need is your standard bad debt file(s) that you already generate today.

Re-Defining “Uncollectable”

The term “uncollectable” no longer must mean “lost forever.” With MONITOR, providers gain a powerful, compliant, patient-friendly tool to recover revenue while maintaining full ownership and control of accounts. The combination of data science, machine learning, and empathetic engagement transforms what was once a sunk cost into a sustainable source of recovered dollars.

The Bottom Line

- Patients’ circumstances change. Many regain the ability to pay, but traditional processes rarely re-engage them.

- Regulations are tightening. Selling debt is becoming less viable and more restricted.

- There’s a smarter solution. MONITOR delivers compliant, data-driven re-engagement that lifts recoveries by 20% or more – without damaging patient relationships.

It’s time to stop leaving money on the table. Let Frost-Arnett show you how much hidden revenue MONITOR can unlock – and start putting more dollars back into your pocket today.

To schedule a time to discuss how Frost-Arnett can help you, please fill out the form below.

Request A Proposal